Catastrophe Adjuster: Expert Assist for Major Insurance Claims

How a Catastrophe Insurer Can Maximize Your Insurance Coverage Case

Browsing the intricacies of an insurance policy case adhering to a calamity can be frustrating, specifically when attempting to make certain a reasonable negotiation. A catastrophe insurance adjuster possesses the experience to simplify this procedure, supplying beneficial understandings that can considerably improve your insurance claim's result. From conducting in-depth inspections to supporting for your legal rights, their duty is crucial in minimizing the stress and anxiety related to cases administration (catastrophic claims adjuster). Comprehending the full extent of their abilities and how they can function to your advantage is crucial-- there are crucial elements that might make all the distinction in your insurance claim experience.

Understanding Catastrophe Insurers

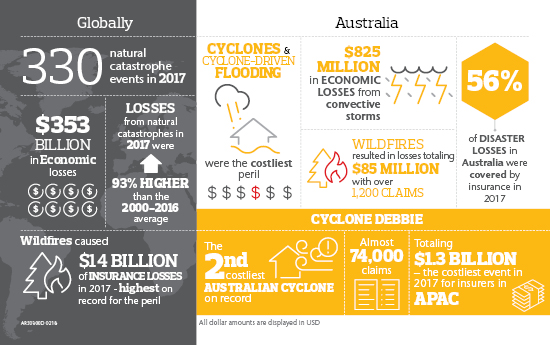

Catastrophe insurance adjusters play a crucial function in the insurance declares procedure, specifically in the consequences of substantial disasters. These experts concentrate on evaluating problems arising from catastrophic events such as cyclones, earthquakes, floodings, and fires. Their competence is vital for precisely examining the extent of losses and figuring out proper settlement for insurance policy holders.

A disaster insurer typically possesses specific training and experience in disaster-related insurance claims, allowing them to browse the intricacies of insurance policies and local policies. They carry out complete examinations of harmed homes, put together in-depth reports, and gather sustaining documentation to validate claims. This process frequently involves working closely with policyholders, contractors, and various other stakeholders to make certain a thorough analysis is completed.

In addition to evaluating physical problems, disaster insurance adjusters also consider the monetary and emotional influence on damaged individuals, providing guidance throughout the cases procedure. Their objective viewpoint assists maintain justness and transparency, guaranteeing that policyholders get the benefits they are qualified to under their insurance coverage - insurance claims recovery. Comprehending the duty of catastrophe adjusters is essential for policyholders looking for to optimize their claims, as their expertise can dramatically affect the result of the claims procedure

Benefits of Employing a Catastrophe Insurance Adjuster

Hiring a disaster adjuster can supply significant benefits for policyholders navigating the cases process after a calamity. These professionals focus on assessing damages from tragic events, making certain that the assessment is exact and comprehensive. Their know-how allows for a detailed understanding of the details involved in insurance coverage cases, which can frequently be overwhelming for insurance holders.

Among the primary benefits of employing a disaster insurer is their capacity to take full advantage of case negotiations. Their knowledge of industry standards and methods enables them to promote successfully in behalf of the policyholder, ensuring that all eligible damages are documented and valued properly. This advocacy can cause greater monetary healing than what an insurance holder could attain by themselves.

In addition, catastrophe insurers bring neutrality to the claims procedure. They are not emotionally bought the consequences of the disaster, permitting them to evaluate damages without predisposition. Their experience in bargaining with insurance companies can accelerate the cases procedure, minimizing delays that frequently happen when insurance holders take care of insurance claims individually.

Inevitably, engaging a catastrophe adjuster can reduce the problem of browsing a complicated insurance policy landscape, giving satisfaction during a difficult time.

The Claims Process Discussed

After your case is filed, an insurance insurer, frequently a catastrophe adjuster in serious situations, will certainly be assigned to assess the damage. This professional will certainly review the degree of the loss, assess your policy for protection, and determine the appropriate settlement. It is essential to document the damage extensively, consisting of photographs and an in-depth supply of shed find out here now or harmed things.

The insurer will then review the case and interact their decision relating to the payout. Throughout this process, preserving clear interaction with your insurer and comprehending your policy will dramatically boost your ability to navigate the cases process properly.

Common Blunders to Prevent

Browsing the insurance policy asserts process can be difficult, and preventing usual challenges is vital for optimizing your payout - insurance claims recovery. One prevalent error is failing to record damages thoroughly. Without proper proof, such as pictures and thorough summaries, it comes to be hard to corroborate your insurance claim. Additionally, ignoring to keep documents of all interactions with your insurance company can cause misconceptions and issues down the line.

An additional usual error is undervaluing the timeline for submitting an insurance claim. Lots of policies have strict target dates, and delays can result in denial.

Furthermore, neglecting plan information can prevent your claim. A catastrophe insurer can give vital support, guaranteeing that you avoid these challenges and navigate the claims process effectively.

Selecting the Right Insurer

When it pertains to maximizing your insurance policy claim, picking the best adjuster is an important step in the procedure. The insurance adjuster you pick can dramatically influence the end result of your insurance claim, influencing both the rate of resolution and the amount you receive.

Following, consider their credibility. Look for reviews or reviews from previous clients to evaluate their reliability and effectiveness. A great insurer must connect clearly and give regular updates on the progress of your claim.

Final Thought

Finally, engaging a disaster adjuster can considerably boost the potential for a favorable insurance policy case end result. Their know-how in navigating complicated policies, performing comprehensive evaluations, and efficiently bargaining with insurance business makes certain that insurance holders obtain reasonable settlement for their losses. By staying clear of typical pitfalls and leveraging the insurance adjuster's specialized understanding, people can optimize their insurance claims and relieve the worries related to the insurance claims process, ultimately resulting in a much more adequate resolution in the results of a This Site catastrophe.

Disaster insurers play an important role in the insurance policy declares procedure, specifically in the after-effects of considerable calamities. Comprehending the duty of disaster adjusters is essential for insurance holders seeking to optimize their claims, as their know-how can considerably influence the result of the claims procedure.

Their experience in negotiating with insurance policy business can speed up the claims procedure, minimizing delays that frequently happen when insurance holders handle claims independently.

After your case is filed, an insurance policy insurer, often a disaster site web insurance adjuster in severe situations, will certainly be assigned to analyze the damages. By preventing typical pitfalls and leveraging the insurer's specialized knowledge, people can optimize their claims and ease the worries linked with the claims procedure, eventually leading to a much more satisfying resolution in the after-effects of a calamity.